6 Easy Tips For Utilizing Metatrade To Get Forward Your Competitors

The Quantum Currency Array indicator is here and delivers in spades. The indicator solely provides you with recommended take profit and stop-loss ranges. As long as bonds with quick maturities yield less than those with long maturities it is worthwhile to purchase the lengthy dated bonds and then sell them after 2-three years, accumulating a profit and reinvesting the proceeds in new long term bonds. You possibly can enter the markets looking to purchase a bond in a company or government, and either make investments long-time period, meaning holding onto the bond; or you might speculate, meaning trading for quick income. The bond markets are an open market like many others. Like with other known dry dishes, its greatest to immediately eat it proper after you purchase it. Which bonds are best to commerce? How are bonds different from stocks? Bonds have a nominal fee of £100 (UK) or $1,000 (US), however these costs can fluctuate when it first involves the market and all through the term, although these with brief durations are less doubtless to alter over time.

The nominal charge is described as the ‘par value’. Prices fluctuate because of supply and demand, the credit score ranking of the company issuing the bond, the coupon fee and how shut it is to the tip of the term. The issuer of the bond, or the indebted entity, will subject a bond that contractually states the interest fee that will be paid and the time at which the loaned funds have to be returned. Meanwhile, the curiosity price, which is usually referred to as the coupon fee or price, is the return that bondholders earn for loaning their funds to the issuer. Meanwhile, callable bonds have the entire traits of a normal bond, but also have a call possibility built into the contract. Every swing technique that works needs to have fairly simple entry filters. The second being a 20 durations Simple Moving Average. Easy to set up, easy device. To wrap up, this guide has coated forex indicators in nice detail, exploring one of the best options out there to traders and highlighting the key areas you need to pay attention to when selecting a provider. So that are finest to commerce?

The nominal charge is described as the ‘par value’. Prices fluctuate because of supply and demand, the credit score ranking of the company issuing the bond, the coupon fee and how shut it is to the tip of the term. The issuer of the bond, or the indebted entity, will subject a bond that contractually states the interest fee that will be paid and the time at which the loaned funds have to be returned. Meanwhile, the curiosity price, which is usually referred to as the coupon fee or price, is the return that bondholders earn for loaning their funds to the issuer. Meanwhile, callable bonds have the entire traits of a normal bond, but also have a call possibility built into the contract. Every swing technique that works needs to have fairly simple entry filters. The second being a 20 durations Simple Moving Average. Easy to set up, easy device. To wrap up, this guide has coated forex indicators in nice detail, exploring one of the best options out there to traders and highlighting the key areas you need to pay attention to when selecting a provider. So that are finest to commerce?

Another thing, a few of the apps are compatible with a couple of operating system. One profitable strategy is called rolling down the yield curve. However lower ranked bonds are often higher for trading as investors will be keen to pay more as they chase the yield. Each has a specific perform, for example the swap is commonly used to decrease an investor’s tax legal responsibility, or to easily improve the yield being collected. There are a lot of different types of bonds, from company bonds issued by individual companies, to municipal bonds that are typically issued to pay for a specific mission, reminiscent of enhancements to colleges, to government Treasuries which fund the Federal authorities. The bond is for a selected duration. All of them use an analogous ranking methodology and the higher a bond is ranked, the safer it's. Rather than considering the source of the bond it is helpful to think about the rating as an alternative.

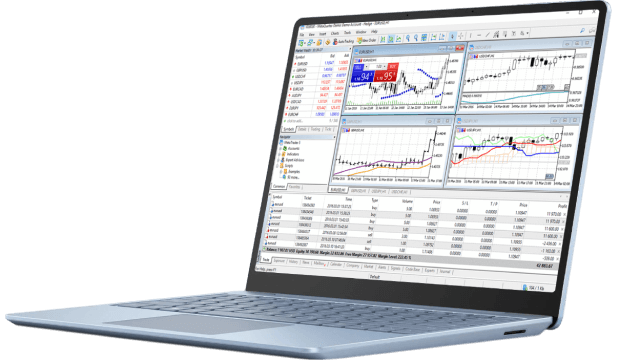

There are three main bond ranking businesses, Standard & Poor’s, Moody’s, and Fitch. Bonds are rated based on threat and credit rankings by establishments like Moody’s and Standard and Poor’s to ascertain the monetary stability of the entity - and subsequently determine the probability of bonds being repaid and the interest charges being met. There are numerous bond trading methods with names like swaps, barbells, and ladders. Up so far, I've mentioned Tradestation strategies - code which you could backtest and see efficiency statistics for. What are some bond trading strategies? The ironic thing is that lots of the most important issuers are also some of the most important purchasers. Some of the most important movers in the bond markets include governments, banks, government agencies, such as Fannie Mae (Federal National Mortgage Association) in the US, and others. You will have the sense of achievement of knowing that you just helped somebody create certainly one of the biggest monetary decisions of their lifetime. On the whole, the MT4 platform’s advantages outweigh its disadvantages, though it does have some much less favourable characteristics. Because the identify implies, MT4 is the fourth platform within the MetaTrader series designed by MetaQuotes Software Corp. Users can opt to auto trade the indicators instantly through the MT5 platform.