In 10 Minutes, I'll Give You The Truth About Mt

A fast method of doing this is to go to the “Autotrading” button found on the top of the platform and activating it for reside trading. In 2018 the top 20 highest-earning hedge fund managers. By nature hedge fund managers are typically secretive, therefore don’t expect them to reveal all of the aces up their sleeves. Flower Petals. Most flowers found in nature contain quite a lot of petals from the Fibonacci sequence: either 1,3,5, 8,13 and even 21 petals. Due to the excessive variety of false breakouts, this system requires strict risk management guidelines and a high level of self-discipline. On this check, we confirm that the system still have the same efficiency parameters as within the take a look at interval. At the identical time, the hedging strategy can be thought of worthwhile if the trader succeeds in limiting the potential threat of an funding. It's possible you'll argue that the same things could be stated about the net forex brokers as effectively. Brokers may also cater for different base currencies. However, different cryptos corresponding to Dash, Ripple, NEO and Stellar Lumens have emerged as crypto assets which are making their way onto platforms featured by crypto forex brokers.

A fast method of doing this is to go to the “Autotrading” button found on the top of the platform and activating it for reside trading. In 2018 the top 20 highest-earning hedge fund managers. By nature hedge fund managers are typically secretive, therefore don’t expect them to reveal all of the aces up their sleeves. Flower Petals. Most flowers found in nature contain quite a lot of petals from the Fibonacci sequence: either 1,3,5, 8,13 and even 21 petals. Due to the excessive variety of false breakouts, this system requires strict risk management guidelines and a high level of self-discipline. On this check, we confirm that the system still have the same efficiency parameters as within the take a look at interval. At the identical time, the hedging strategy can be thought of worthwhile if the trader succeeds in limiting the potential threat of an funding. It's possible you'll argue that the same things could be stated about the net forex brokers as effectively. Brokers may also cater for different base currencies. However, different cryptos corresponding to Dash, Ripple, NEO and Stellar Lumens have emerged as crypto assets which are making their way onto platforms featured by crypto forex brokers.

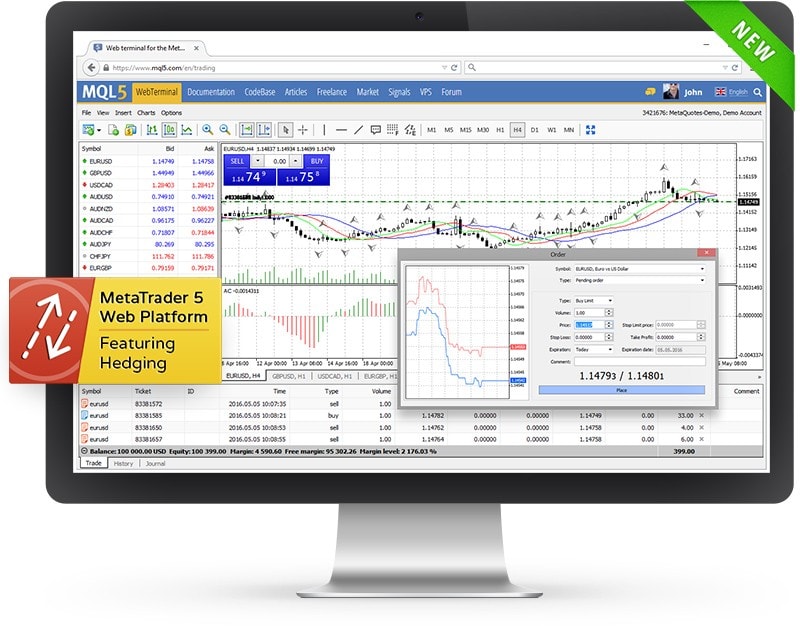

Basically, hedging is whenever you open trades to offset one other commerce that you've already opened. Traders may fall into the lure of pondering that since we're fully hedged, we will just let the commerce run for weeks and months with out worrying about it too much. It's also possible to use scalping techniques with the Keltner Channel if you wish to be in and out of a commerce quickly. Check out our free stock trading class by clicking on the banner beneath and learn to commerce like a pro immediately. Try this article for extra on hedging. However, there's nothing fallacious to take a look at what other experts are shopping for. Besides five chart types, there can also be a tick chart - a useful feature that isn’t supplied by each broker. One of the best feature of IvyBot is that it upgrades itself routinely with none extra cost as a result of its price is included with the life time upgrading of the software program. Understanding the price relationship between different currency pairs can help to cut back risk and refine your hedging methods. Alternatively, you can choose a number of prepared-to-use EAs, downloadable without spending a dime from Code Base, or purchase or rent from “MetaTrader Market,” the largest retailer of ready-to-use trading purposes.

Regardless of which varieties of hedging methods you use, you need to grasp that there aren't any free lunches in trading. You could have an edge when trading NEO coins which is the rationale why we use a second indicator to confirm that real institutional buying is behind this breakout. So, that’s one of many checks it is advisable to make. So, staying focused on the long-time period is critical. George Soros was in a position to forecast this event properly upfront using his world macro technique. Whether you want the idea of hedging or not, listed here are some benefits of using hedging in forex trading. Within the arms of CMC Markets, you can use MT4 to commerce indices and commodities as well as forex. In this case, you need to use the oil hedging technique to hedge your exposure on the USD/CAD commerce. The most important misconception amongst retail traders is that the Forex hedging strategy means inserting an equal. Considering all things equal with the earlier example, at the tip of year 4, you get back $20,000 (1,000 shares x $20). Global macro hedge funds may even become involved in numerous asset courses (stocks, bonds, currencies, commodities or interest rates). However, if you want to get around the FIFO rule you should use a number of currencies to hedge your transactions.

Those three transactions collectively kind a hedge. Historically, Gold has all the time been perceived as a kind of cash, which is the reason why it’s a superb hedge against a dollar collapse or in opposition to hyperinflation. In abstract, the ability to go both long and short in an asset is what makes these hedge fund methods and tools so helpful in the daily operation of a multi-billion hedge fund boutique. This is an ideal hedge and an ideal instance of hedging strategies that use multiple currencies. Third, we should also observe that a Forex hedging strategy is related to prices which will eat up features - hedging with Forex Options is one such example. Let’s say for example of hedging methods that you buy the USD/JPY. Let’s now look at other types of hedging strategies. But, let’s first begin by discussing what's hedging risk and what a hedging technique is. A proper hedging technique should protect a trader from a giant loss in the quick time period.