Indicator 2.0 - The following Step

And before that I used SuperCharts, which was the forerunner to the TradeStation charting platform. It launched its trading platform in 1991 and is headquartered in Plantation, Florida. Simulated trading. This feature permits traders to check strategies with hypothetical cash utilizing simulated market data. Our favourite day trading strategy Day Trading Price Action- Simple Price Action Strategy can teach you the best way to profitably day commerce any market. Conversely, when the stock markets flip down, we’re in a risk aversion sort of surroundings and investors will promote risky property in which case the carry trade is not going to work. Answering what is a metatrader, we will try to explain in a easy method in order that it is easy to know for rookies. From the trader’s standpoint, this is a much superior way of trading Bitcoins when in contrast with trading on exchanges. Set this up to run routinely, each week, at 3am so it doesn’t get in your means. TradeStation doesn’t provide crypto wallets. There’s a $35 annual fee for IRA accounts, a 0.3% payment for trading crypto and a $50 annual inactivity payment for accounts of lower than $2,000.

And before that I used SuperCharts, which was the forerunner to the TradeStation charting platform. It launched its trading platform in 1991 and is headquartered in Plantation, Florida. Simulated trading. This feature permits traders to check strategies with hypothetical cash utilizing simulated market data. Our favourite day trading strategy Day Trading Price Action- Simple Price Action Strategy can teach you the best way to profitably day commerce any market. Conversely, when the stock markets flip down, we’re in a risk aversion sort of surroundings and investors will promote risky property in which case the carry trade is not going to work. Answering what is a metatrader, we will try to explain in a easy method in order that it is easy to know for rookies. From the trader’s standpoint, this is a much superior way of trading Bitcoins when in contrast with trading on exchanges. Set this up to run routinely, each week, at 3am so it doesn’t get in your means. TradeStation doesn’t provide crypto wallets. There’s a $35 annual fee for IRA accounts, a 0.3% payment for trading crypto and a $50 annual inactivity payment for accounts of lower than $2,000.

Both demo and stay accounts may be open at the same time - this permits for methods to be trialled and examined alongside actual money trading. Forex Islamic accounts are ideal for Muslim purchasers as they align with the Islamic faith. Matrix. Matrix is TradeStation’s name for its Level 2 market information, which allows you to see the costs orders are ready to be executed. On the fifth day, we’re on the lookout for the market to put an finish to the retracement. By trying at the EMA crossover, we create an automated purchase and promote indicators. But both companies supply access to the same securities lineup and permit trades to be executed throughout TradeStation’s web and cellular applications. With 5 of those web pages beneath their belts (AffiloJetpack allows people to resolve on 5 of 10 niches) an individual ought to undoubtedly be seeing some glorious benefits. Retail traders who do not need a lot free time to be in front of the display whole day advantages from setting limit orders tremendously. Shannon Terrell is an editor for Finder who has written over four hundred personal finance guides. That mentioned, the signup course of is pretty straightforward.

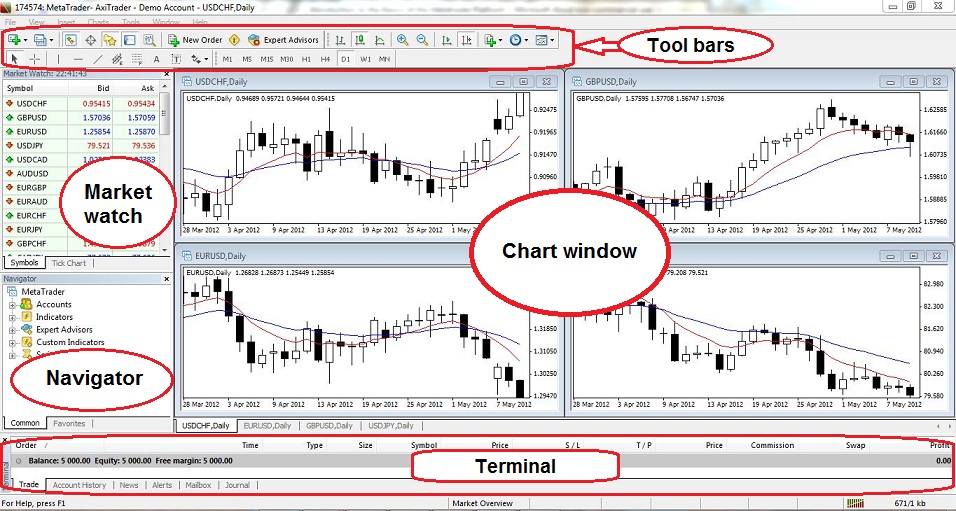

Join a TradeStation account from a desktop or mobile device, and the six-step software process will be accomplished in beneath 10 minutes. 1. Start the signup course of on TradeStation’s web site via your desktop or cellular app. Signup bonus info updated weekly. Disadvantages (“Cons”)- Won't be updated or mounted by house owners of the software license.- New Forex / CFD brokers launching from 2018 won't be able to offer the MetaTrader 4 platform.- No social trading element (although social trading usually does extra hurt than good, so this could be a bonus as an alternative of a drawback).- Programming language used for Expert Advisors (EAs) is totally different to that used within the MetaTrader 5 trading platform.- The back-testing functionality doesn't come with high-high quality historical information.- Some users complain of comparatively slow execution, and broker manipulation of the platform, though it's unclear how brokers can be less ready to manipulate other trading platforms.

The broker is regulated in multiple jurisdictions by among the top tier regulators. Now we have completely revised the chart display mannequin making it potential to use a number of indicators simultaneously. Once each of those variables has been recognized, you will be able to create a Heiken Ashi chart. Let's see if we can generate income with the Heiken Ashi candlesticks? Now, let’s see how the same DBLHC pattern seems to be on the Stellar XLM chart. I see so many charts from traders the place they’ve plotted the present futures contract (e.g. ESZ19). If you use the “continuous” contract version (e.g. @ES) as a substitute, the rollover happens robotically - plus all of the history is already on the chart. The 7th day is still essentially the most active contract, so I favor “rolling” the data on the following day, the sixth day earlier than contract expiry. Charts settings and history information parameters are grouped in this tab. 2. When the CMF volume readings are below the zero level, it reveals selling stress and the truth that we’re in an uptrend.