Turn Your Trading Proper Into A High Performing Machine

The entry and exit methods for day trading are fairly simple. We at Trading Strategy Guides have a transparent understanding of what is absolutely occurring at these vital levels because we all the time make certain we backtesting our methods so they've a positive expectancy. We encourage everyone to experiment with totally different take revenue strategies. 5: Take Profit One we Break. We take revenue on the earliest symptom of market weakness which is a break under the 1/1 line that indicators a possible start of a bearish transfer. Manage trading activities on the premise of the signals acquired. Knowing the strengths and weaknesses of different technical evaluation tools, you need to use them to validate one another's signals. The aim of the article is a comparative evaluation of the technical analysis methods used by analysts in as we speak's international currency market; evaluating the chosen instruments of each method and determining the most effective ones. Results. Within the framework of this study three important methods of technical analysis of the international forex market had been considered: graphic, methodology of mathematical approximation and principle of economic cycles.

The entry and exit methods for day trading are fairly simple. We at Trading Strategy Guides have a transparent understanding of what is absolutely occurring at these vital levels because we all the time make certain we backtesting our methods so they've a positive expectancy. We encourage everyone to experiment with totally different take revenue strategies. 5: Take Profit One we Break. We take revenue on the earliest symptom of market weakness which is a break under the 1/1 line that indicators a possible start of a bearish transfer. Manage trading activities on the premise of the signals acquired. Knowing the strengths and weaknesses of different technical evaluation tools, you need to use them to validate one another's signals. The aim of the article is a comparative evaluation of the technical analysis methods used by analysts in as we speak's international currency market; evaluating the chosen instruments of each method and determining the most effective ones. Results. Within the framework of this study three important methods of technical analysis of the international forex market had been considered: graphic, methodology of mathematical approximation and principle of economic cycles.

Due to the unpredictability of the dynamics of the international foreign money market and the potential of losses from the performed transactions, the examine of technical means turns into of specific importance and relevance. One in every of the biggest errors retail traders make will not be looking at the large image pattern, and the four candle hammer strategy capitalizes on this market pitfalls. Failure to reject H0 implies that there are not any advantages from exploiting the trading strategy being thought-about, whilst a rejection suggests that the adopted strategy can generate abnormal income. The following logical thing we want to ascertain for the Gartley harmonic pattern trading technique is the place to take profits. Usually, you want to place your protective stop loss under wave X. That’s the logical place to hide your stop loss as a result of any break below will automatically invalidate the Fibonacci requirements for a Gartley harmonic. If the Stop Loss and Take Profit ranges specified are too near the current price, the error message will appear, and the levels won't be placed. Resistance ranges. Unlike the standard horizontal help and resistance ranges, the Gann fan angles are mathematically calculated based on the value, time and the value vary of the market.

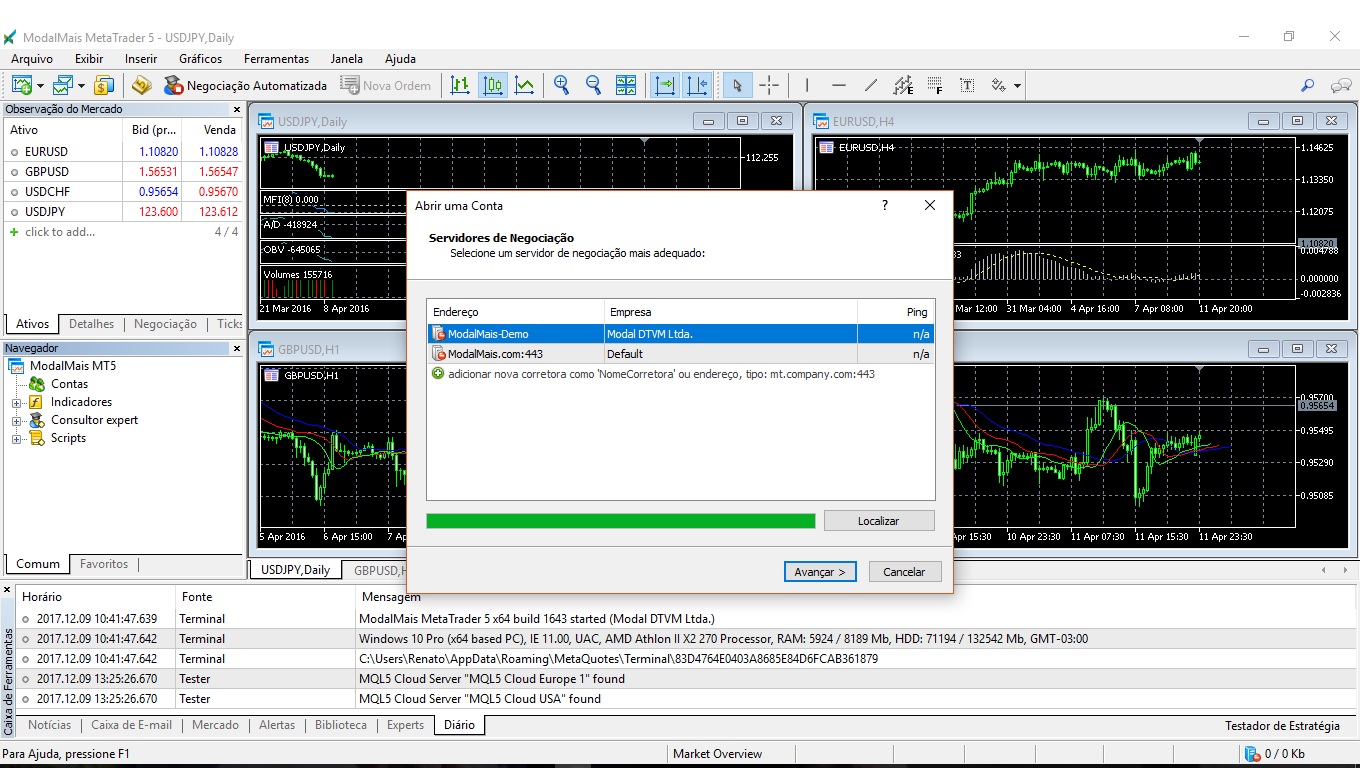

In case you want to learn extra about Multiple time-frame evaluation, read our article. Common features of methods of technical evaluation of the forex market are: the aim of the evaluation, the article of evaluation and the affect of the factor «psychology of people». MT4 has 30 built-in technical indicators whereas MT5 has 38 built-in technical indicators. Technical analysis is an assessment of the conduct of the international forex market over a period of time. As virtually every Forex /CFD broker gives using MetaTrader four on the time of writing, it is a standard determination which new traders face. Gann believed that when worth and time transfer in sync, that’s the best stability of the market. Now, let’s move ahead to an important a part of this article. It can be utilized to all markets because in accordance with the Gann concept, financial markets transfer on account of human habits. Based on Gann idea, there are particular angles you may draw on a chart. We now have special Gann fan angles and more particularly Gann got here up with 9 totally different angles (see figure above). If you have been following all of these steps, all of the other Gann fan angles ought to adjust to the Gann guidelines.

Traders on platforms have these instruments can know when the next significant financial information is due and plan for it. Most sophisticated trading platforms should incorporate these instruments. Note: Above was an instance of a Buy commerce using the Bullish Gartley harmonic pattern trading technique. The above was an example of a buy commerce using the very best Gann fan strategy. FXCM stories that MT4 has totally customisable algorithms that users can alter using the Integrated Development Environment (IDE) and the MQL4 programming language. You may test our software free of charge as long as you want. You need to buy on the market as soon as we break above 1/1 line. Once a bullish Gartley price action has been identified and subsequently, the swing D leg in worth has been formed thus producing a purchase sign we will go one step forward and define a great location for our protective stop loss and a great target. 1.272 - 1.618 of AB leg. While it options a person-pleasant interface, new traders could discover it challenging to use at first.

Traders on platforms have these instruments can know when the next significant financial information is due and plan for it. Most sophisticated trading platforms should incorporate these instruments. Note: Above was an instance of a Buy commerce using the Bullish Gartley harmonic pattern trading technique. The above was an example of a buy commerce using the very best Gann fan strategy. FXCM stories that MT4 has totally customisable algorithms that users can alter using the Integrated Development Environment (IDE) and the MQL4 programming language. You may test our software free of charge as long as you want. You need to buy on the market as soon as we break above 1/1 line. Once a bullish Gartley price action has been identified and subsequently, the swing D leg in worth has been formed thus producing a purchase sign we will go one step forward and define a great location for our protective stop loss and a great target. 1.272 - 1.618 of AB leg. While it options a person-pleasant interface, new traders could discover it challenging to use at first.